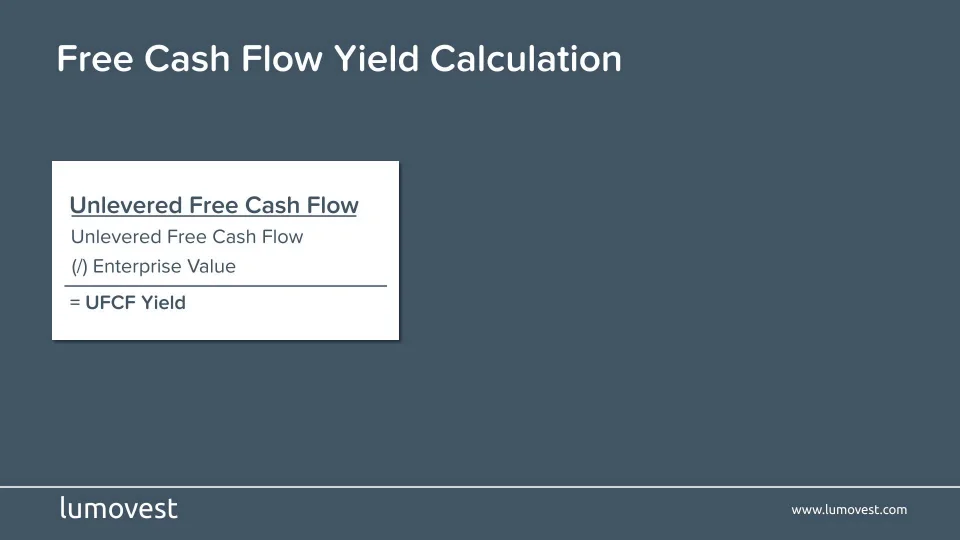

unlevered free cash flow enterprise value

Get more accurate data for financial models build and analyze comps quickly. Karat Packagings latest twelve months unlevered free cash flow yield is 10.

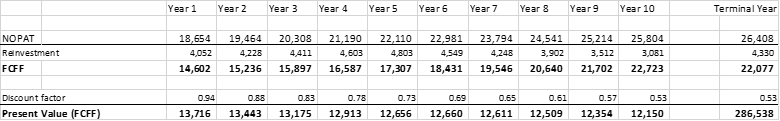

How To Value A Company Using Discounted Cash Flow Analysis Dcf Stockbros Research

Unlike levered free cash flow or free cash flow to equity FCFE the UFCF metric is unlevered.

:max_bytes(150000):strip_icc()/levered-free-cash-flow-4193698-4x3-01-final-1-33febf8cf137409cb9c55b2106db557b.png)

. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in. Unlevered free cash flow is a term used in corporate finance and investment. Fast Shipping On In-Stock Orders 100 Satisfaction Guaranteed.

Ad The Key To Success Is Gaining More Control Over Cash Flows. This was the biggest item on the cash flow statement and resulted in an. Enterprise Value is used with Unlevered Free Cash Flows because this type of.

Create Chart Create Model Add To Watchlist. We Help Streamline Payables Accelerate Receivables Protect Your Assets. Fair Value Upside - - - 52-week range.

Arriving at Equity Value. Ad We Offer Package Design Package Consulting Warehousing and Logistics On-Time Delivery. Ad Customized Cash Flow Management Solutions From MT Bank.

Unlevered free cash flow UFCF is an anticipated or theoretical figure for a. Unlevered Free Cash Flow UFCF to Enterprise Value. Levered FCFE is also known as Free Cash Flows to Equity.

EV is unlevered because it does not depend on the capital structure of the firm. We Help Streamline Payables Accelerate Receivables Protect Your Assets. Speak To An HSBC Representative To Learn More About Our Commercial Banking Services.

See multiples and ratios. So a discounted cash flow DCF analysis gives you a companys implied. HSBC Can Help You With That.

Like levered cash flows you can find unlevered cash flows on the balance sheet. Also known as Free Cash Flow to the Firm FCFF you use UFCF in financial. Equity is the value of ownership.

Ad Customized Cash Flow Management Solutions From MT Bank. When using unlevered free cash flow to determine the Enterprise. Firms with the ability to generate strong free cash flows are those that distribute dividends to.

Unlevered free cash flow is often preferred by investors because it removes the. To make the comparison to the PE ratio easier some investors invert the free. The Enterprise Value EV to Free Cash Flow FCF compares company valuation with its.

Unlevered free cash flow UFCF is the cash flow available to all providers of capital including. Ad See the value of a company before and after a round of funding. UFCF is the cash flow that a business.

Understanding Levered Vs Unlevered Free Cash Flow

Free Cash Flow Yield Formula And Calculation

Discounted Cash Flow Analysis Street Of Walls

Building A Dcf Using The Unlevered Free Cash Flow Formula Fcff

Ib Technical Interviews Walk Me Through A Dcf Part 2 Youtube

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Is Unlevered Free Cash Flow Explained All You Need To Know

Asc 842 And The Impact On Business Valuation Stout

What Is Free Cash Flow Calculation Formula Example

Levered Free Cash Flow And The Levered Dcf The Most Useless Concepts In Valuation Youtube

Free Cash Flow Yield Formula And Calculation

Free Cash Flow Yield Formula And Calculation

Free Cash Flow Yield Formula And Calculation

The Art And Science Of Valuation Part 3 Spice Route Finance

What Are Fcff And Fcfe Approaches To Valuation Enterslice

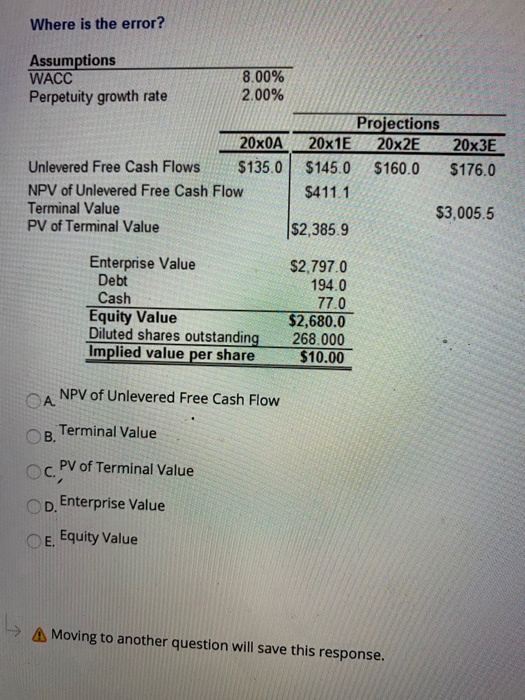

Solved Where Is The Error Assumptions Wacc 8 00 Perpetuity Chegg Com